Analyzing a REIT for Contribution or Investment: Key Performance Indicators

A step-by-step guide to top-down (qualitative) and bottom-up (quantitative) analyses of a REIT - evaluating the broader picture before narrowing it down to specific details.

- Author

- Danish Jahangir Mir

Before contributing your assets to or making an investment into a Real Estate Investment Trust (REIT), it is imperative to conduct thorough due diligence. REITs use several Non-GAAP financial measures that are not used by other types of real estate companies. Therefore, even real estate sponsors that are well-versed in analyzing investments under GAAP standards should spend time understanding how to underwrite REITs before considering a transaction. This article is a step-by-step guide to analyzing REITs. To holistically understand a REIT’s prospects, both a top-down and bottom-up approach must be utilized.

Table of contents

Top-Down Analysis of a REIT: The Fundamentals

When considering a contribution to a REIT, it's essential to conduct a top-down analysis. This involves looking at the broader picture before narrowing it down to specific details. For a REIT, this means first examining the fundamentals of the trust, such as the quality of the properties it owns, its diversification strategy, and the credit profiles of its tenants. Let's use Equity Residential's 2021 Annual Report as a real-world example to illustrate these points.

Portfolio Quality

The quality of a REIT's properties is a crucial factor in its potential for success. High-quality properties are more likely to attract reliable tenants and generate consistent income. When evaluating property quality, consider factors like location, condition, and the type of property. For example, properties in desirable locations with high foot traffic and properties that are well-maintained or recently renovated are generally considered higher quality. Equity Residential, for instance, owns rental apartment properties located in and around Class A markets in the United States that attract affluent long-term renters. They have a portfolio of assets totaling more than 80,000 apartment units located in established and expansion markets.

Diversification

Diversification is a key aspect to consider when analyzing a REIT. A well-diversified REIT owns properties in different geographic locations. This helps to spread risk and protect the trust from potential downturns in any one area. A REIT that owns properties across the country, for instance, is less likely to be severely impacted by a regional economic downturn than a REIT that only owns properties in one city or state. Equity Residential demonstrates this principle by owning properties in different geographic locations, including established markets like Boston, New York, Washington, D.C., Seattle, San Francisco, and Southern California, as well as expansion markets like Atlanta, Denver, Dallas/Ft. Worth, and Austin. They have been repositioning their portfolio to move away from being concentrated in just six coastal markets by adding properties in markets exhibiting favorable long-term return dynamics.

Tenant Credit Profiles

Finally, consider the credit profiles of the REIT's tenants. Tenants with strong credit profiles are more likely to fulfill their lease obligations, providing a steady stream of income for the REIT. On the other hand, tenants with poor credit profiles may pose a higher risk of default. Equity Residential targets affluent long-term renters who are employed in high-earning sectors and geographies of the economy. This strategy ensures that their tenants are not rent-burdened, which creates the ability to raise rents more readily in good economic times and mitigate for tenant default risk during downturns.

Financial Metrics

In the world of REITs, several key financial metrics are used to evaluate performance. These metrics are different from those used in traditional GAAP accounting, and it's important to understand what they are and how they're calculated.

Net Asset Value (NAV)

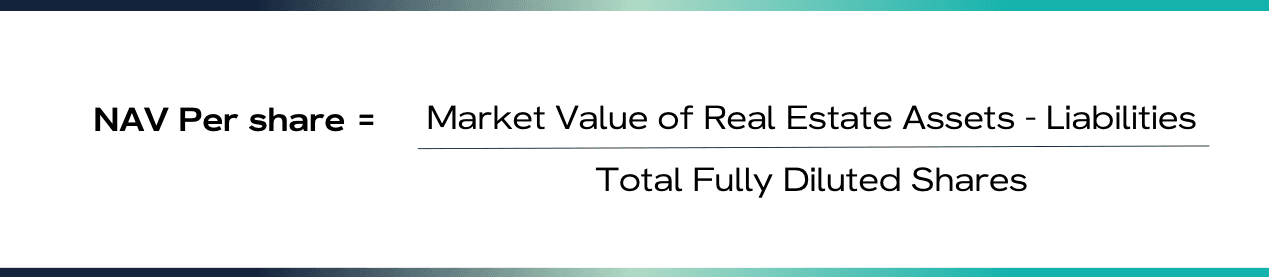

Net Asset Value (NAV) is a measure of a REIT's total value. It's calculated by taking the market value of a REIT's assets and subtracting the total value of its liabilities. The result is then divided by the number of fully diluted shares to get the NAV per share (NAVPS).

We always recommend using the fully diluted share count, instead of outstanding shares, as this accounts for any possible sources of dilutions.

Funds from Operations (FFO)

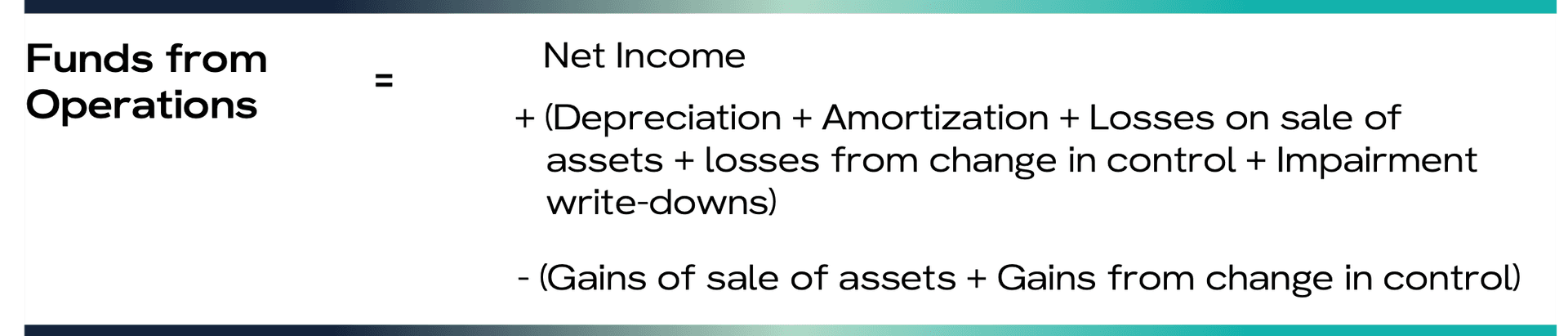

Funds from Operations (FFO) is a measure of a REIT's operating performance and shows the cash generated by the REIT. The term was coined by Nareit. The official Nareit Funds from Operations (FFO) metric adjusts Net Income (calculated in accordance with GAAP) by excluding:

- depreciation expense and amortization related to real estate,

- gains and losses from property sales,

- gains and losses from change in control, and

- impairment write-downs of real estate assets and investments in entities where the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity.

The primary reason for using FFO instead of REIT's net income (the "earnings" in P/E) is that net income includes the depreciation expenses of real estate assets. However, depreciation is a non-cash expense, and real estate generally appreciates or maintains its value over time, rather than depreciate. FFO addresses this issue by adding back depreciation and amortization expenses related to real estate. It also excludes any gains or losses from the sale of properties, change of controls, and impairment write-downs as these are typically one-time events that do not reflect the REIT's ongoing profitability. This makes FFO a better measure of a REIT's operating performance and its ability to generate cash from its real estate portfolio. A REIT's FFO (if public) is typically disclosed in the footnotes section of its income statement.

Adjusted Funds from Operations (AFFO)

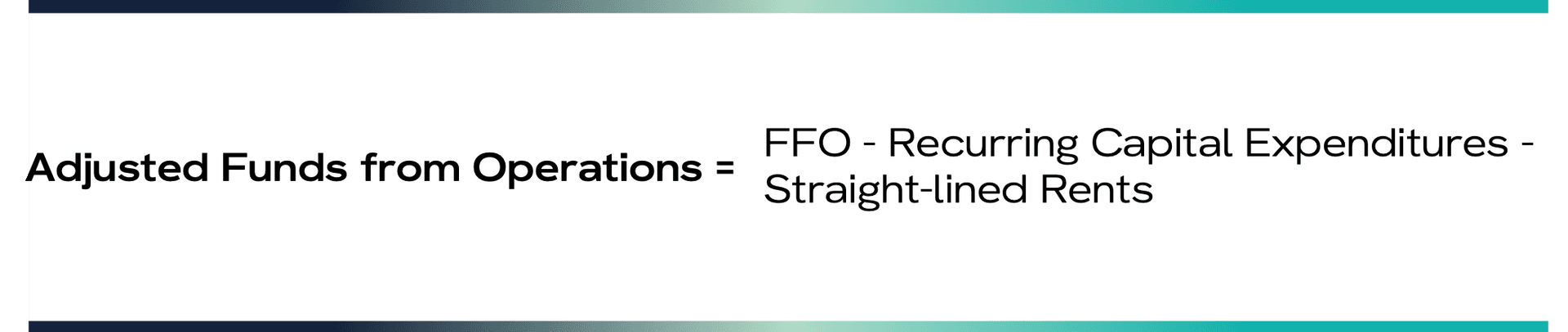

While FFO provides a more accurate picture of a REIT's operating performance than net income, it still has some limitations. One of these is that it doesn't account for recurring capital expenditures - the money a REIT spends to maintain and improve its properties- including routine maintenance expenditures. These expenditures are a regular and necessary part of a REIT's operations, and they can have a significant impact on the REIT's cash flow.

Other adjustments may be required to effectively calculate the AFFO, such as subtracting the straight-lining of rents, which distributes rent expenses over the life of the property. Straight-line rent is the concept that the total rents under a rental arrangement should be recorded as income on an even periodic basis over the term of the contract.

While there is no official formula for the calculation of AFFO, all approaches subtract recurring capital expenditures from FFO.

This provides a clearer picture of a REIT's cash flow, which is a crucial factor in its ability to pay dividends to shareholders. In fact, AFFO is often referred to as the "dividend-paying capacity" of a REIT.

Net Operating Income (NOI)

Net Operating Income (NOI) is a measure of a REIT's income from property operations. It's calculated by subtracting operating expenses from operating income. This gives a more accurate picture of a REIT's income from its properties, as it excludes income from non-property sources.

NOI = Operating Income - Operating Expenses

Bottom-Up Analysis of a REIT: Understanding the Value

REIT valuation models can be prepared through three approaches:

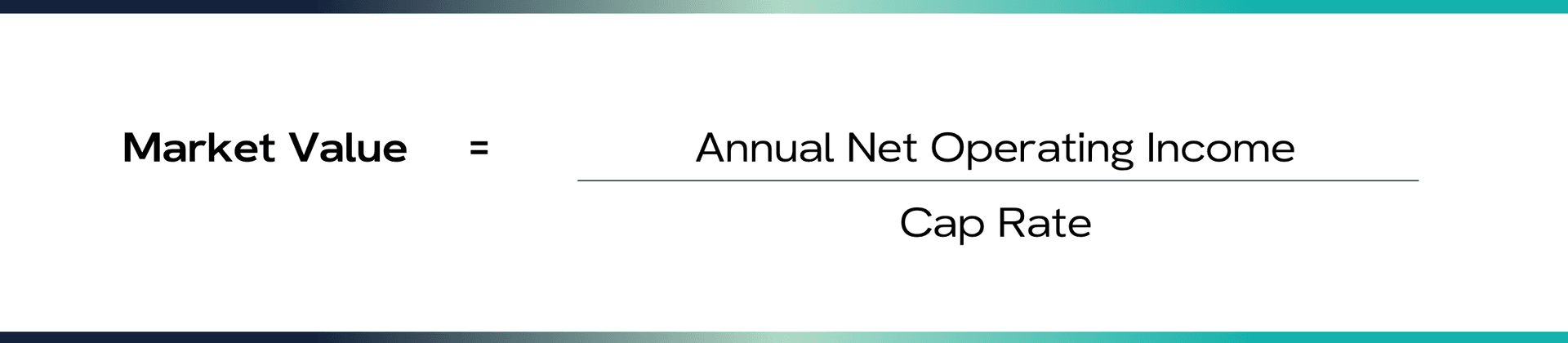

- Net Asset Value (NAV) Model: While calculating the NAV, as discussed above, it is imperative to stress test the appraised values of the REIT's assets by finding a comparative capitalization rate (Cap Rate) for the REIT's portfolio. For example, if the REIT is a multifamily operator in Class A markets, look for comparative cap rates for similar properties in the marketplace. Then apply the cap rate to the REIT's NOI to determine a cap rate based Market Value of the portfolio.

- Price to Funds from Operations (P/FFO) Model: Compare a REIT’s P/FFO ratio to its peers to understand its comparative value.

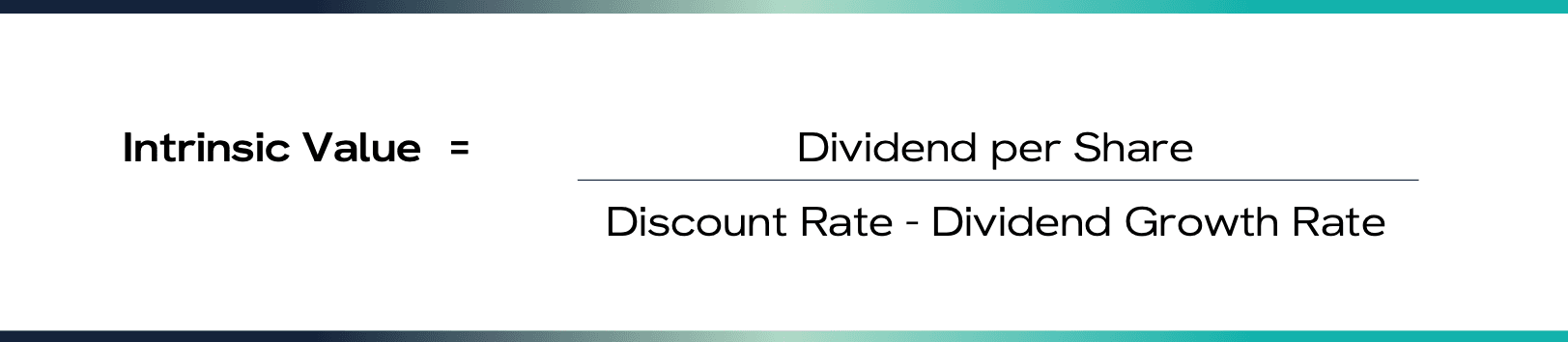

The P/FFO of a REIT is evaluated against the P/FFO of comparable REITs in the same sector. If the P/FFO of a REIT is higher than that of its comp set, it indicates a premium, and if it is lower, it indicates a discount. A deeper dive into the public filings and disclosures of the REIT is required to understand the factors that are either driving a premium or forcing a discount and how they can affect the price of a REITs shares over the horizon of an investment into the REIT or over the planned holding period of shares (including OP units) received for the contribution of assets. 3. Dividend Discount Model (DDM): The DDM is based on the concept that a REIT's intrinsic value is the present value of its future dividends. It is most suitable for REITs with stable and predictable dividend streams. This model takes into account the expected dividend per share, the discount rate (often the investor's required rate of return), and the dividend growth rate.

Ideally, multiple valuation approaches should be deployed when conducting a share analysis of the REIT. This analysis can help you understand whether the securities you are being offered by the REIT are at par, overvalued, or undervalued, how the future share price would fare against today's price, and when is the right time to invest in or transact with a REIT. The same analysis can also help you evaluate the compliance standards of a REIT.

How CIEL Can Help

REITs are phenomenal but complex capital markets vehicles that require careful due diligence and analysis. CIEL's team can help you with the entire process - from sourcing and evaluating potential REITs to negotiating and structuring deals for the best economics and under the right structure. Our team's expertise goes beyond the day of closing.